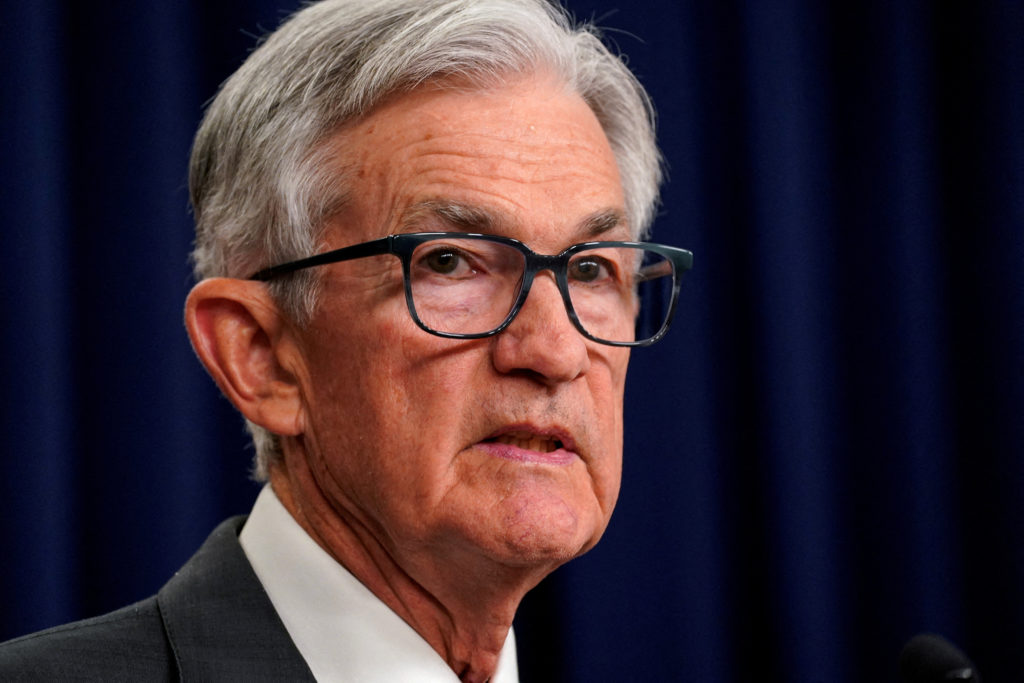

Powell's Remarks: Trump's Trillion-Dollar Debt Plan

Webtuts

Jun 02, 2025 · 7 min read

Table of Contents

Powell's Remarks: Trump's Trillion-Dollar Debt Plan – A Deep Dive into Economic Implications

The year is 2019. A contentious presidential election looms, and the then-incumbent, Donald Trump, unveils a bold, trillion-dollar infrastructure plan. This wasn't just another campaign promise; it was a significant economic proposal that immediately sparked debate among economists, policymakers, and the public. Central to this debate was the reaction of Jerome Powell, then-Chairman of the Federal Reserve, and the implications of such a massive debt-fueled undertaking for the already burgeoning US national debt. This article delves deep into Powell's response to Trump's plan, exploring the economic context, the potential consequences, and the lasting impact of this clash between fiscal and monetary policy.

The significance of understanding this historical moment lies in its relevance to contemporary economic challenges. The issues raised – the interplay between fiscal expansion and monetary policy, the sustainability of high national debt levels, and the impact of large-scale government spending on inflation – remain critically important today. Analyzing Powell's response provides valuable insight into how central banks navigate politically charged economic decisions and the potential repercussions of prioritizing short-term political gains over long-term economic stability.

Powell's Cautious Response: A Balancing Act

Powell's reaction to Trump's trillion-dollar infrastructure plan wasn't a straightforward condemnation or endorsement. Instead, it reflected a cautious approach, emphasizing the importance of fiscal responsibility and the potential risks associated with significantly increasing the national debt without corresponding revenue increases. His statements weren't direct attacks on the plan itself, but rather warnings about the potential negative consequences, particularly in the context of the existing economic environment.

He stressed the importance of fiscal sustainability. While acknowledging the potential benefits of infrastructure investment for long-term economic growth, Powell highlighted the risks of adding trillions to the national debt without a clear plan for how this debt would be repaid. He emphasized the potential for increased interest rates and the crowding-out effect, where increased government borrowing could lead to higher interest rates for businesses and consumers, hindering private investment and economic growth.

Furthermore, Powell emphasized the need for responsible fiscal policy to ensure that the economic benefits of infrastructure spending outweighed the potential risks associated with increased debt. This nuanced approach reflected the Federal Reserve's mandate – to maintain price stability and maximum employment – which could be jeopardized by uncontrolled fiscal expansion. He pointed out that excessive government borrowing could fuel inflation, potentially negating the positive impacts of the infrastructure plan.

Powell's measured response avoided direct confrontation with the President, maintaining the independence of the Federal Reserve. However, his carefully worded statements served as a clear indication of the central bank's concerns regarding the potential economic implications of the plan. This careful balance underscored the delicate relationship between the executive branch and an independent central bank, where open disagreement on crucial economic policy is unavoidable but must be navigated with caution.

Dissecting the Economic Implications: A Deeper Dive

Trump's infrastructure plan, even if successfully implemented, presented several significant economic challenges:

-

Increased National Debt: The most obvious consequence was a substantial increase in the national debt. This increase could lead to higher interest payments, consuming a larger portion of the federal budget and potentially crowding out other essential government spending.

-

Inflationary Pressures: A massive injection of government spending into the economy, without a corresponding increase in productive capacity, could lead to inflationary pressures. This is particularly true if the economy is already operating near full employment, as was the case in 2019.

-

Crowding-Out Effect: As the government borrows heavily, it competes with businesses and consumers for available capital. This competition can drive up interest rates, making it more expensive for businesses to invest and for consumers to borrow money for purchases like homes and cars.

-

Long-Term Economic Growth: While infrastructure investment can boost long-term economic growth, the effectiveness depends heavily on the quality of projects undertaken and their ability to improve productivity. Poorly planned projects could lead to wasted resources and limited return on investment.

-

International Implications: A rapidly increasing US national debt could negatively impact the US dollar's value and potentially increase borrowing costs for the US government in international markets.

Powell's concerns were rooted in these economic realities. He recognized the potential for short-term economic gains from infrastructure spending but emphasized the importance of considering the long-term implications of a dramatically increased national debt. His remarks acted as a warning, highlighting the need for fiscal prudence and a comprehensive plan to mitigate the potential risks.

The Science Behind the Concerns: A Simplified View

The concerns raised by Powell are supported by established economic principles:

-

Keynesian Economics: While supportive of government spending during economic downturns, Keynesian economics also emphasizes the need for fiscal responsibility and careful management of government debt. Uncontrolled expansionary fiscal policy, particularly when the economy is already performing well, can lead to inflation and unsustainable debt levels.

-

Supply-Side Economics: This school of thought emphasizes the importance of tax cuts and deregulation to stimulate economic growth. However, even supply-side economists acknowledge the need for responsible fiscal policy and caution against excessive government debt.

-

Monetary Policy and Fiscal Policy Interaction: Powell's remarks highlighted the complex interplay between monetary and fiscal policy. When the government engages in expansionary fiscal policy, the central bank (the Federal Reserve) may need to adjust monetary policy (interest rates) to manage inflation and maintain price stability. This coordination is crucial, but often challenging to achieve, especially in politically charged environments.

Frequently Asked Questions (FAQ)

Q1: Was Powell against Trump's infrastructure plan entirely?

A1: No, Powell didn't explicitly oppose the plan. His concerns focused on the potential negative economic consequences of significantly increasing the national debt without a corresponding plan for fiscal responsibility. He emphasized the need for a comprehensive approach that balanced the potential benefits of infrastructure investment with the risks of excessive debt.

Q2: How did Trump respond to Powell's remarks?

A2: Trump, known for his criticisms of the Federal Reserve, frequently attacked Powell and accused him of hindering economic growth by raising interest rates. The President's response often framed Powell's concerns as political opposition rather than an objective economic assessment.

Q3: Did Powell's concerns materialize?

A3: While Trump's infrastructure plan didn't fully materialize to the initially proposed scale, the increasing national debt remained a significant concern. The subsequent economic events, including the COVID-19 pandemic, further exacerbated this issue. The increased government spending during the pandemic demonstrated the challenges of balancing fiscal stimulus with long-term debt sustainability.

Q4: What lessons can we learn from this episode?

A4: This episode highlights the importance of responsible fiscal policy, the need for clear communication and coordination between the executive branch and the central bank, and the potential risks associated with prioritizing short-term political gains over long-term economic stability. It also showcases the challenges of balancing economic growth with fiscal sustainability, a challenge that continues to face policymakers today.

Q5: How does this relate to current economic issues?

A5: The debates surrounding Trump's infrastructure plan and Powell's response are highly relevant to current economic concerns. The ongoing challenges of managing high national debt levels, balancing fiscal stimulus with inflation control, and navigating the complex interplay between monetary and fiscal policy remain central to contemporary economic discussions.

Conclusion and Call to Action

The exchange between Jerome Powell and the Trump administration regarding the proposed trillion-dollar infrastructure plan serves as a critical case study in the complex relationship between fiscal and monetary policy. Powell's measured response, emphasizing fiscal responsibility and the potential risks of excessive debt, highlighted the importance of considering long-term economic consequences alongside short-term political goals. The enduring lessons from this episode remain crucial as policymakers navigate similar challenges in today's economic landscape.

We encourage you to further explore the intricacies of fiscal and monetary policy by reading our articles on [Link to related article 1] and [Link to related article 2]. Understanding these crucial aspects of economic management is vital for navigating the complexities of the modern financial world.

Latest Posts

Latest Posts

-

Youkilis Slams Aocs Virtue Signaling On Colorado Shooting

Jun 04, 2025

-

Justin Thomas Preps For Tough Oakmont U S Open

Jun 04, 2025

-

Wanted Man Captured After Highway Crash

Jun 04, 2025

-

Aoc Responds Boulder Shooting Aftermath

Jun 04, 2025

-

Wsop Update Negreanu Vs Blom Championship Showdown

Jun 04, 2025

Related Post

Thank you for visiting our website which covers about Powell's Remarks: Trump's Trillion-Dollar Debt Plan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.